Advanced VHI Service for Corporate Health Management

Client

The client is a leading provider of voluntary health insurance (VHI) services, catering to businesses of all sizes. With a focus on delivering innovative and flexible health insurance solutions, the company is committed to enhancing employee well-being while helping businesses manage risks and reduce costs. Their services span across various industries, offering tailored solutions to meet the unique needs of their clients.Due to confidentiality agreements, specific details about the client cannot be shared.

Challenge

The client faced the challenge of modernizing and streamlining its voluntary health insurance services while improving risk management processes. They needed an integrated solution to calculate insurance quotes efficiently, while also adopting advanced risk mitigation strategies to reduce financial losses.The company also wanted to enhance transparency and customer engagement through automated processes and personalized offers. Additionally, the challenge was to ensure the scalability and security of the platform to meet the growing demands of businesses across various sectors.

Objective

- Enable accurate and dynamic insurance quote generation based on diverse client needs.

- Implement advanced risk management strategies to minimize financial exposure.

- Improve transparency, client communication, and trust through streamlined processes and automated updates.

- Optimize the platform for scalability and security to ensure future growth and adaptability.

- Enhance operational efficiency by automating reporting, data analysis, and client engagement.

Solutions Implemented:

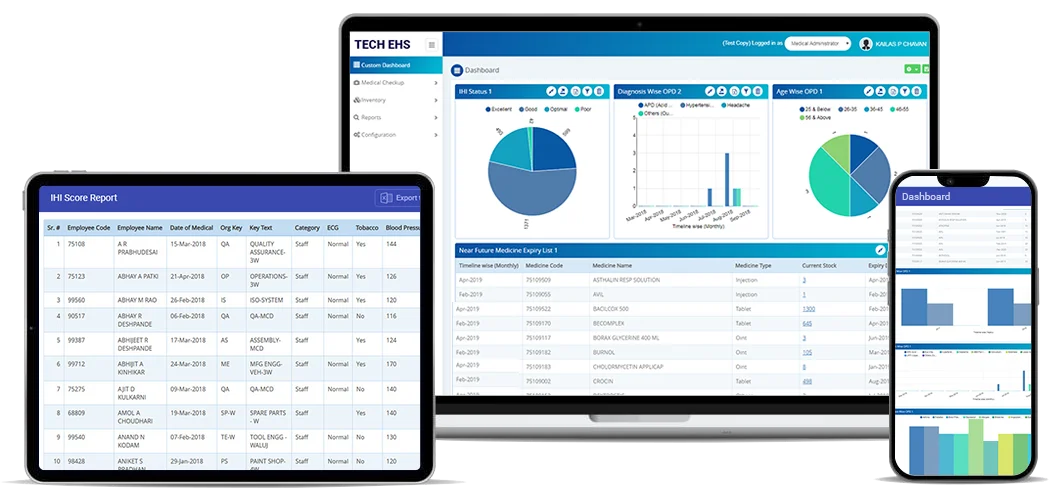

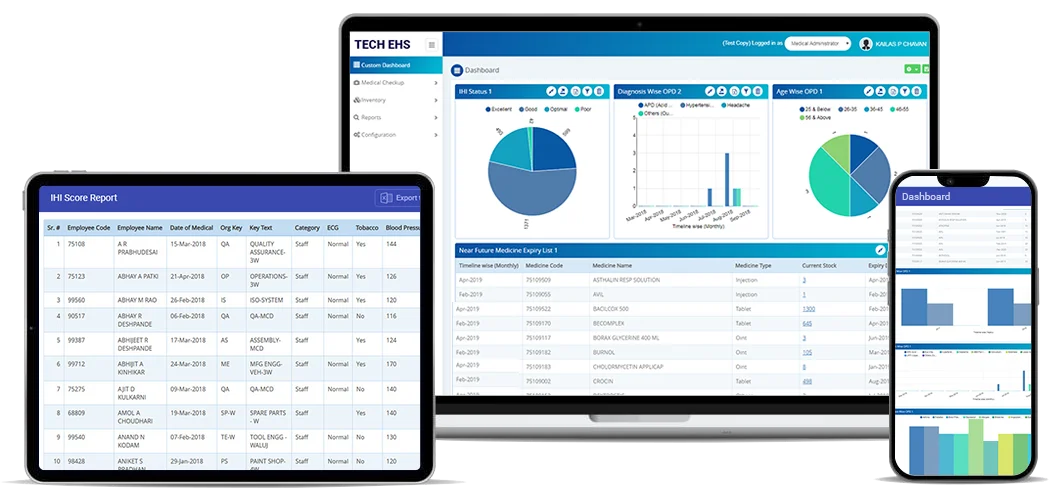

HR Dashboard Module

A service that provides HR departments of client companies with detailed reports on medical services rendered, allows for the signing of additional agreements for new rates, and adds new employees to the existing VHI program.Quote Calculation Module

A dedicated microservice that generates customized insurance quotes based on client specifications, utilizing machine learning models to calculate the cost of medical insurance programs while considering all selected risks.Risk Management Module

This module integrates sophisticated algorithms to assess and evaluate the risks associated with various health insurance programs. It ensures that only the most cost-effective and secure options are recommended, reducing financial exposure.Email Notification Service

A robust system for sending automated updates and offers to clients through multiple mail providers, increasing engagement and ensuring customers receive relevant communications such as quarterly reports and new service offers.Report Generation Optimization

The code was optimized to reduce the time taken for generating reports with detailed analytics, enhancing operational efficiency and providing clients with faster insights into their health insurance data.Results Achieved:

Team

Technical Stack:

- Python 3.x

- Django

- Django Rest Framework

- FastAPI

- SQLAlchemy

- Alembic

- Pydantic

- PostgreSQL

- Celery

- RabbitMQ

- Pandas

- Numpy

- Docker

- Docker Compose

- Kubernetes

- Yandex Cloud

- GitLab

- CI/CD

- Bitwarden

- Keycloak

- Swagger API

- Nexus

- Pytest