Payroll Integration Multifunctional SDK

The platform offers a secure and multifunctional SDK for bank account users, ensuring the safe exchange of sensitive information between banks and clients. By encrypting data, the platform significantly reduces the risk of data leaks during transactions.

Conversational AI

Chatbots

Customer Support

Python

Real-Time processing

Machine Learning

Customer

NicheFinancial TechnologiesLocationUSAYear2020

A fintech company on a mission to create a fairer financial system by providing innovators with the tools needed to build financial fairness for all. They focus on solving real consumer challenges and empowering companies with a reliable platform that caters to everyone's needs.Detailed information about the client cannot be disclosed under the provisions of the NDA.

Challenge

Our task was integration with different U.S. banks and fintech projects. Ensure end-to-end (E2E) encryption of sensitive user data in compliance with the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) posed a significant challenge.

Solution:

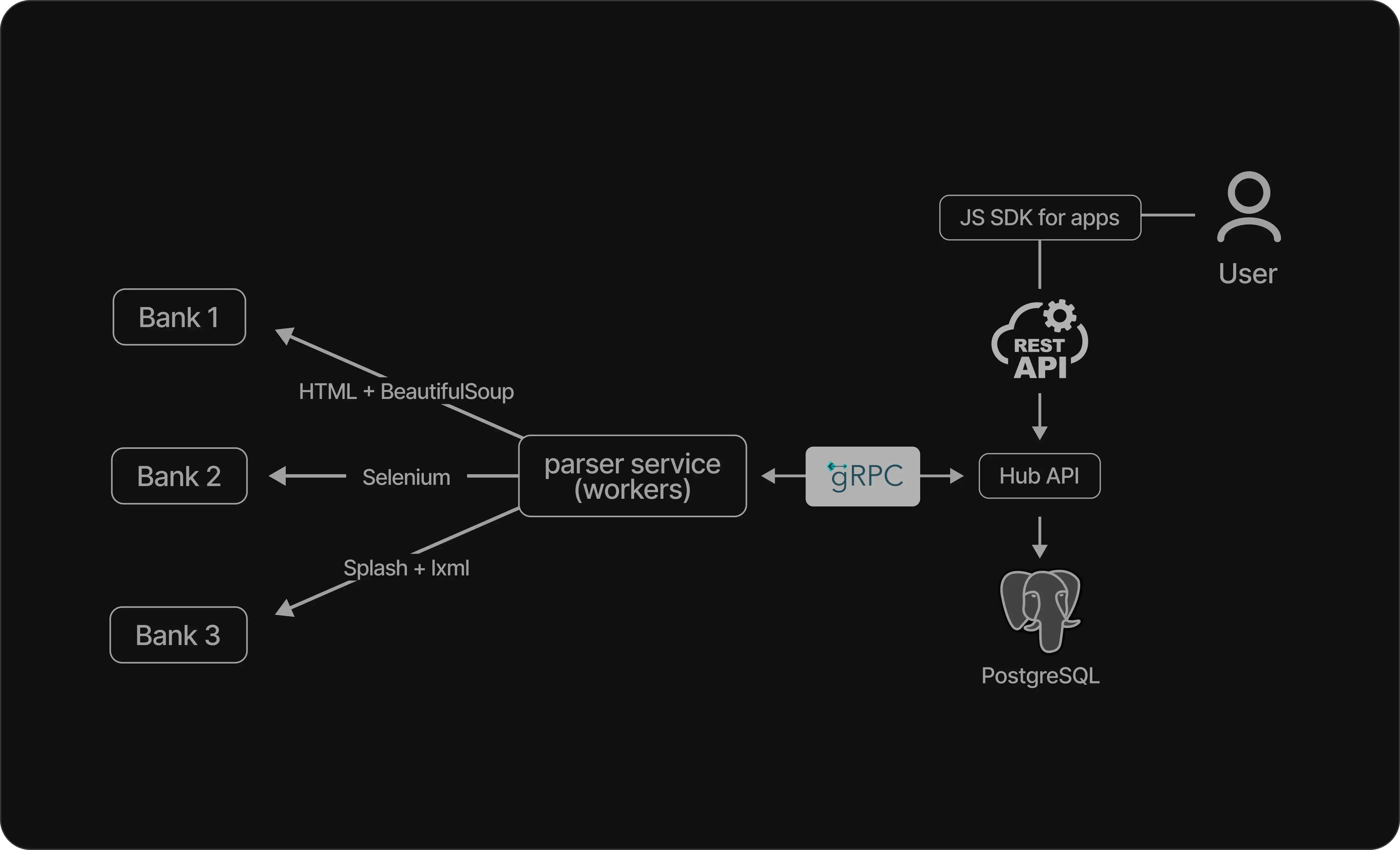

To address the complex requirements of the project, our team harnessed the power of an extensive tech stack, including Python, Scrapy, Selenium, beautifulsoup4, lxml, PostgreSQL, Redis, Celery, gRPC, Pydantic, Splash, and AWS (Amazon Web Services). This comprehensive solution allowed us to deliver a cutting-edge SDK with exceptional functionality and security.Python served as the core programming language, providing the flexibility and versatility needed for efficient development. We utilized Scrapy, Selenium, beautifulsoup4, and lxml to extract data from various sources, ensuring accurate and reliable information retrieval.For secure data storage and management, we used PostgreSQL, a powerful and scalable relational database management system. Redis, coupled with Celery, facilitated efficient task queue management and improved overall system performance.

For seamless communication between different components, we implemented gRPC, a high-performance framework that facilitated fast and reliable inter-service communication. This allowed for seamless integration with various U.S. banks and fintech projects, ensuring smooth data exchange.To enforce data validation and maintain data integrity, we employed Pydantic, a powerful data validation library. This ensured that the SDK operated with consistent and valid data throughout the integration process.Splash, a headless browser, was utilized to render dynamic web pages and extract relevant information, providing a seamless user experience for the end-users. Lastly, the use of AWS as the cloud infrastructure provided scalability, high availability, and robustness. It enabled us to deploy and manage the SDK with ease, ensuring optimal performance and reliability.

Results

Pynest successfully developed a comprehensive payroll integration SDK that streamlined banking and tax operations. The solution met the client's objectives, enabling seamless bank switching, automated tax form submissions, and user-friendly KYC verifications. Moreover, the implementation of end-to-end encryption in compliance with GDPR and CCPA ensured the utmost security and data privacy for the end-users.

95%time savings on financial reporting

19%increase in the user base

Team

3

Back-end Engineers

2

Fullstack engineers

1

Team lead

Technology Stack:

Parsing

- BeautifulSoup

- Splash

- Selenium

- lxml

Backend

- Python

- gRPC

Platforms

- AWS